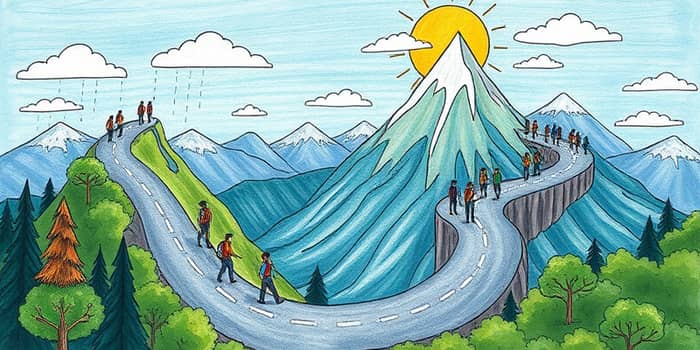

Markets move in waves, reflecting shifts in economic activity, investor sentiment, and global events. Understanding these cycles can transform your investment success and foster long-term resilience in any financial environment.

Market cycles are recurring patterns of economic growth and decline that influence asset valuations and investor behavior. Unlike business cycles, which track outputs like GDP and employment, market cycles manifest through price movements, trading volumes, and collective psychology.

Investor sentiment often reaches extremes—exuberance at peaks and fear at troughs. U.S. economic cycles average around 5.5 years but can be shorter or much longer. For example, the 2008 financial crisis contraction lasted just over a year, while stimulus-driven recovery after the 2020 pandemic was remarkably swift. By recognizing psychological and technical signals, investors can better align strategies with each phase.

Each stage—expansion, peak, contraction, trough—presents unique portfolio implications. Accurate phase identification is key to capitalizing on emerging trends and avoiding full brunt of reversals.

Integrating multiple indicators enhances predictive power. For instance, combining unemployment trends with profit margin data and Fed rate outlooks creates a clearer picture of whether an expansion can extend or a slowdown is imminent. Regular monitoring ensures timely strategy adjustments.

Customizing your approach to the current cycle phase enhances long-term performance while reducing drawdowns. Below are the core strategies for each stage, complemented by historical context and average market returns.

Accumulation/Expansion: Characterized by relatively rapid economic growth, low borrowing costs, and rising corporate profits. Investors should build positions in undervalued or cyclical sectors—technology, small-cap stocks, and firms with robust earnings potential. Dollar-cost averaging into broad indexes or targeted themes smooths purchase prices. Historically, the S&P 500 has returned around 14.8% annually during growth extensions since 2012.

Mark-up/Peak: As prices surge and optimism peaks, valuations can become stretched. Investors should remain invested but start harvesting gains and rebalancing into defensive assets—utilities, consumer staples, and high-grade bonds. Partial profit-taking helps secure returns before sentiment shifts. In past peaks, profit margins and margin debt levels have signaled overextension.

Distribution/Contraction: Economic output slows, and market tops form as buyers and sellers are nearly equal and trading volumes decline. Focus on income-generating and low-volatility holdings. Shift weight toward healthcare, utilities, and investment-grade bonds. Maintain or raise cash reserves to shield the portfolio from sharp drawdowns, historically averaging -20% or worse in bear markets.

Mark-down/Trough: Markets bottom amid panic selling and price capitulation. Volatility spikes while sentiment hits multi-year lows. Patient investors can gradually accumulate high-quality equities and broad ETFs at discounted levels. Focus on companies with strong balance sheets, stable dividends, and low leverage. Capturing rebounds early often yields outsized returns when the recovery phase commences.

Emotions drive many market turns. Fear prompts selling in downturns, while greed fuels bubbles at peaks. Staying disciplined requires clear rules and objective measures. Diversification and rebalancing across asset classes reduce the impact of any single market shock.

Behavioral biases—overconfidence, anchoring, and herding—can derail even well-crafted plans. Regularly reviewing portfolio allocations, setting stop-loss or take-profit levels, and maintaining a personal investment policy statement enforce discipline.

Technical tools such as moving average crossovers, breadth indicators, and relative strength help detect trend shifts, while fundamental analysis ensures that holdings align with earnings growth and valuation frameworks. Additionally, recognizing that external shocks can abruptly shift market trajectories prepares investors mentally for sudden volatility.

Passive investors often ride out market cycles using low-cost index funds or ETFs, relying on broad market returns over time. This strategy reduces fees and sidesteps timing risks. Active investors, however, attempt to rotate between sectors—financials in expansion, industrials nearing peaks, and staples during contraction—to capture incremental gains.

Sector rotation demands careful analysis of leading indicators (yield curves, commodity prices) and valuation metrics (P/E ratios, forward earnings). Timing rotations effectively can enhance returns and manage risk, though transaction costs and tax considerations must be factored in.

Market cycles are an inevitable aspect of investing that present both challenges and opportunities. Each stage—from accumulation through mark-down—offers distinct chances to grow wealth or safeguard capital. By combining a solid understanding of cycle phases, vigilant indicator tracking, and disciplined risk management, investors can navigate turbulent waters with confidence.

Flexibility, patience, and adherence to a systematic process are paramount. Whether you lean passive or pursue active rotation, staying aware of psychological traps and preparing for unexpected shocks paves the way for sustained financial success.

References