In an age of market turbulence and shifting economic landscapes, traditional stocks and bonds alone may not provide the resilience or growth potential investors seek. Alternative assets offer paths to broaden horizons, capture unique opportunities, and build more robust, diversified portfolios that stand the test of time.

Meet Sarah, a mid-career professional who allocated 20% of her savings to real estate crowdfunding and private equity funds. Over five years, she experienced steadier returns and reduced volatility compared to peers focused solely on equities. Her journey illustrates how stepping beyond public markets can open doors to higher risk-adjusted performance and personal empowerment through financial innovation.

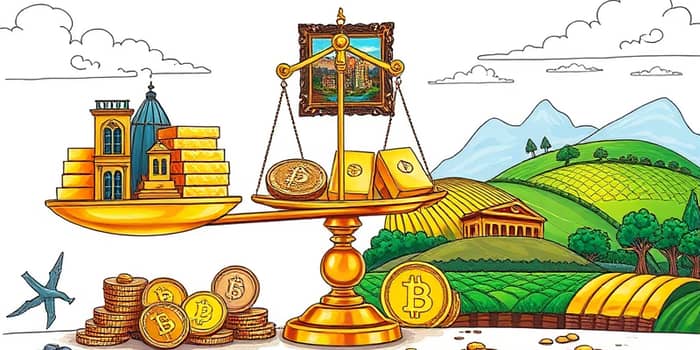

Alternative assets encompass investments outside of stocks, bonds, and cash. They include everything from physical commodities and collectible art to digital currencies and private debt instruments. Unlike publicly traded securities, most alternatives are not listed on exchanges and trade less frequently, contributing to their distinct risk and return characteristics.

By integrating alternative holdings, investors tap into markets that often move independently of traditional benchmarks. This low correlation with equities helps cushion portfolios during downturns and capture growth when public markets underperform.

Private equity investments involve direct stakes in companies, often requiring long horizons of seven to ten years. Within this category, venture capital backs early-stage startups, while buyout funds acquire mature firms to enhance operations and sell at a premium.

Real estate spans residential, commercial, and agricultural properties. Farmland not only offers steady rental income but also serves as a tangible inflation hedge. Similarly, commodities like gold and oil provide tangible value and a proven hedge against inflation when currency values weaken.

Traditional portfolios often lean heavily on stock market rallies. By contrast, alternative assets may thrive when equities falter. During periods of high inflation, real assets such as commodities and real estate typically outperform bonds, preserving purchasing power and offering steady income streams.

Crowdfunding platforms now allow retail investors to participate in deals once reserved for institutions. Art aficionados can join fractional ownership of masterpieces, unlocking potential appreciation without requiring enormous upfront capital.

Illiquidity means you may not be able to exit quickly without discounts to fair value. Many private funds impose lock-up clauses ranging from three to ten years. Fees often include both management charges and performance-based carry, which can erode net returns.

Rigorous due diligence is crucial. Understanding the track record of fund managers, market dynamics, and underlying asset quality reduces unexpected exposures and maximizes the chance of success.

Integrating alternatives requires thoughtful allocation. Modern portfolio theory suggests that a blend of stocks, bonds, and a 10–20% slice of alternatives can enhance risk-adjusted returns. Your mix should reflect time horizon, liquidity needs, and risk tolerance.

Within each alternative category, further diversify by geography, sector, and strategy. For example, in real estate, balance residential and commercial exposures; in private debt, include senior secured and mezzanine instruments. Such layering fortifies your portfolio against sector-specific shocks.

First, assess your personal financial plan and ensure you have an emergency cash buffer. Next, explore reputable platforms and registered advisors specializing in alternative assets. Seek offerings with transparent fee structures, demonstrated track records, and clear governance frameworks.

Start with smaller commitments to gain experience, then gradually scale allocations as you grow comfortable with the pace of valuations, distributions, and reporting. Maintain discipline, avoid chasing unrealistic returns, and align each investment with your overarching goals.

Historically, private equity delivered annualized returns of 10–15% over two decades, outpacing the S&P 500. Farmland total returns averaged around 8% annually, combining land appreciation with crop revenues. Crypto markets have seen exponential growth, albeit with dramatic drawdowns.

Alternative assets are powerful tools for investors seeking to expand beyond conventional stocks and bonds. While they carry unique challenges—such as lower liquidity and higher fees—the potential rewards in terms of diversification and return enhancement can be substantial.

By crafting a thoughtful allocation strategy, performing diligent research, and working with experienced professionals, you can harness the strengths of private markets, real assets, and innovative financial instruments. Embrace the journey of alternative investing to build a more resilient, dynamic portfolio that reflects your long-term aspirations.

References